BY MBONO MDLULI

MBABANE – Former Ndzingeni Member of Parliament (MP) Lutfo Dlamini believes that it is challenging for Africa to depend on external aid.

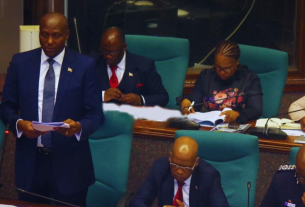

Dlamini was making his presentation at the prestigious 2024 MEDays International Forum in Tangier, Morocco. The meeting started on Wednesday (November 27, 2024) and will end tomorrow (Saturday, November 30, 2024).

The former Minister of Foreign Affairs and International Cooperation presentation under the topic: ‘Innovative Strategies and Development in Africa: Mobilising and Directing Financing to Achieve the SDGs.’

Addressing over 6 000 delegates from across the globe, Dlamini’s speech focused on the critical need for innovative financial strategies to address the challenges faced by Africa in achieving the United Nations’ Sustainable Development Goals (SDGs).

The former Minister of Labour and Social Security emphasised that Africa’s development needs were immense, as the continent grappled with challenges such as high poverty rates, inequality, limited access to essential services like healthcare and education, and vulnerability to climate change. He noted that Africa’s financing gap to achieve the SDGs was estimated at $200 billion (about E3.6 trillion) annually, underscoring the need for fresh approaches to resource mobilisation.

During his address, Dlamini outlined the significant challenges Africa faced in securing the financing necessary to meet the SDGs, as listed below:

- Limited Domestic Revenue Mobilisation: Low tax-to-GDP ratios and widespread tax evasion hinder the ability of many African nations to raise domestic funds.

- Dependence on External Aid: Many African countries rely heavily on foreign aid, which is both volatile and insufficient.

- Private Sector Underinvestment: The perceived risks in African markets, coupled with governance concerns, discourage private investment.

- Debt Sustainability: Rising debt levels in several countries limit fiscal capacity, affecting the ability to invest in critical development sectors.

- Climate and External Shocks: Natural disasters, pandemics, and geopolitical conflicts continue to strain resources. To address these challenges, Dlamini presented several innovative financing strategies:

- Domestic Resource Mobilisation: Improving tax systems, leveraging natural resource revenues, and ensuring transparent governance can boost local resource mobilisation.

- Blended Finance: Combining public and private sector investments, especially for SDG-related projects, is key to de-risking high-potential sectors like renewable energy and infrastructure.

- Green and Blue Bonds: Issuing bonds to finance climate adaptation projects and sustainable ocean resource management.

- Leveraging Technology: Digital platforms and mobile money solutions can enhance financial inclusion and efficiency, as seen with Kenya’s M-Pesa.

- Diaspora Bonds and Remittances: Tapping into African diaspora communities for investment and development funding can create new channels of financing.

- Impact Investing: Attracting investors who seek both financial returns and measurable social and environmental impacts.

The former Minister of Enterprise and Employment highlighted several African countries that have made significant strides in mobilising financing for sustainable development:

Rwanda: Achieved robust tax collection systems and healthcare financing reforms.

Morocco: Issued green bonds to fund its renewable energy projects.

Kenya: Revolutionised financial inclusion with the M-Pesa mobile money platform.

Ethiopia: Secured international financing for large-scale infrastructure projects like the Grand Ethiopian Renaissance Dam (GERD).

The role of multilateral institutions such as the African Development Bank (AfDB), World Bank, and UNDP is crucial in supporting Africa’s financing needs. These organisations provide concessional loans, grants, and capacity-building initiatives to help African countries achieve the SDGs.

Recommendations for the Future: To successfully meet the SDGs, Dlamini recommended several strategies for African Governments:

- Strengthening governance and transparency to attract more investment.

- Diversifying financing sources to reduce dependency on foreign aid.

- Investing in capacity-building and institutional reforms.

- Fostering regional cooperation to address shared challenges.

- Prioritising climate-resilient and inclusive growth strategies.

In conclusion, Dlamini’s address at the MEDays International Forum reinforced the need for innovative, multi-faceted approaches to financing Africa’s development and achieving the SDGs. His call for greater collaboration, transparency, and investment in technology and infrastructure resonated with the delegates, offering a hopeful vision for Africa’s future.

According to Wikipedia, MEDays is an annual international forum which is organised every year in Tangier under the high patronage of King Mohammed VI, and is the main event organised by the Amadeus Institute. During several days, it confronts and brings together different readings, opinions and recommendations from high level international policymakers on essential topics and issues concerning the South.