… Meanwhile, banking assets grew by 9.9%, reaching E28.9 billion

BY MBONGENI NDLELA

MBABANE – Central Bank of Eswatini Governor Dr Phil Mnisi says key indicators are signalling improvements in the country’s household financial health.

Mnisi said the financial institution has observed a slight reduction in financial stress in the household sector.

In economics, the household sector is an institutional sector in national accounts that includes all households in an economy. Households are individuals or small groups who share a living space, pool some or all of their income and wealth, and consume goods and services together.

Mnisi today presented the 2024 Financial Stability Review (FSR), unpacking the significant milestone and ongoing commitment to promoting a robust, resilient, and inclusive financial system that serves as the cornerstone of sustainable economic growth and development in Eswatini.

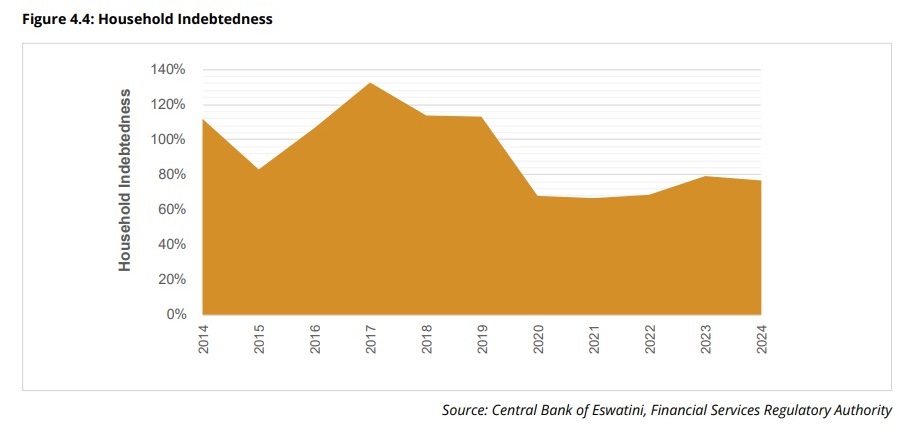

The Governor noted one notable development, which was the decrease in household indebtedness. He said it fell to 74.3% in June 2024 from 79.1% in the previous year.

He explained that this reduction is largely attributed to increased disposable income and an overall improvement in financial conditions.

“The debt-service ratio, which tracks the proportion of income devoted to servicing debt, also saw a slight improvement, closing at 54.8% from 55.1% in June 2023,” he disclosed.

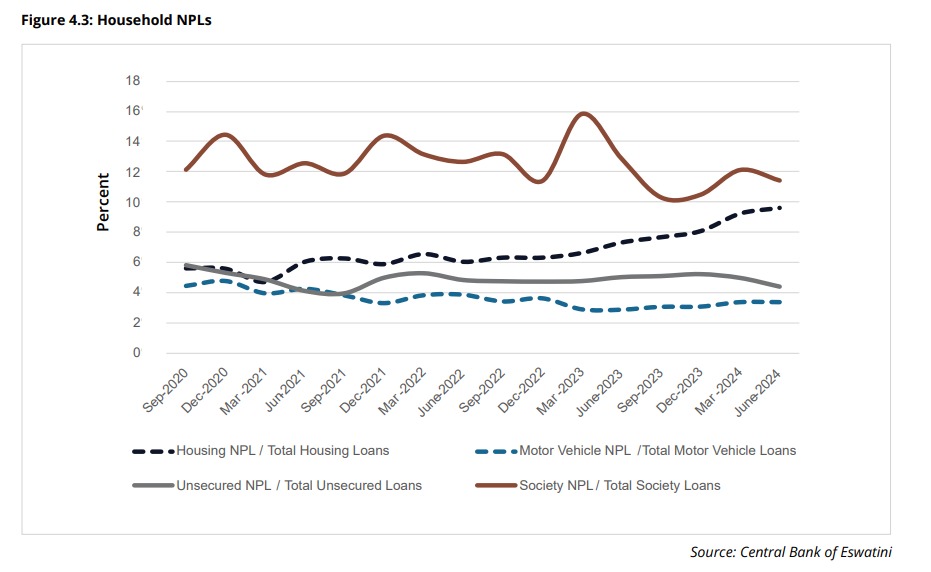

However, Mnisi stated that unsecured lending remains a concern while the household sector shows signs of relief.

He said a significant portion of household debt continues to be in the form of unsecured loans, which remain vulnerable to interest rate fluctuations and changes in disposable income.

“Despite a slight improvement in non-performing loans for unsecured credit, ongoing monitoring is necessary to ensure that these loans do not pose a greater risk to financial stability, particularly if interest rates rise or economic conditions worsen,” he said.

In his introductory statement, Mnisi highlighted that the FSR is the Aggregate Financial Stability Index (AFSI). He said, by definition, the AFSI is a composite indicator that combines multiple economic and financial variables to assess the overall health and stability of the financial system.

“It acts as an early warning system, identifying potential risks and vulnerabilities that could trigger financial instability or crises,” he said.

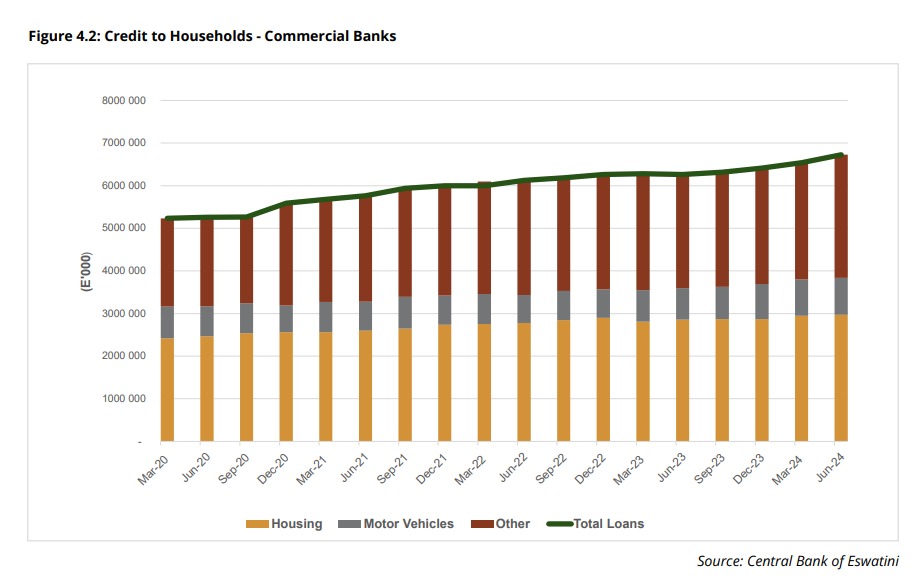

Meanwhile, Mnisi disclosed that Eswatini’s banking sector has remained robust and resilient during the review period. He said total banking assets grew by 9.9%, reaching E28.9 billion.

“This growth was largely driven by a 12.8% increase in new lending, reflecting strong demand for credit. Total deposits also rose by 10.1%, further strengthening the sector’s base,” he said.

He continued: “One of the key indicators of stability within the sector is capital adequacy. Although there was a decline in capital levels, with Tier 1 Capital dropping from 16.5% to 15.4%, banks still maintain a solid buffer, with an average Capital Adequacy Ratio of 17.4%. This is well above the 8% regulatory minimum, indicating that the sector is adequately capitalised to absorb potential shocks,”

He said despite these positive indicators, profitability faced significant pressures.

“Return on Assets decreased from 2.6% to 2.0%, and Return on Equity fell from 17.3% to 13.8%. The increase in operational expenses, particularly related to rising interest costs and staff expenses, has impacted banks’ ability to generate profits. Additionally, liquidity slightly weakened, with the liquidity ratio declining from 33.8% to 30.9%. This underlines the need for careful liquidity management in the period ahead,” he said