BY MBONGENI NDLELA

MBABANE – The pension sector’s assets have grown substantially by 11 percent, reaching E50.1 billion.

Central Bank of Eswatini Governor Dr Phil Mnisi disclosed this when presenting the 2024 Financial Stability Review (FSR), unpacking the significant milestone and ongoing commitment to promoting a robust, resilient, and inclusive financial system that serves as the cornerstone of sustainable economic growth and development in Eswatini.

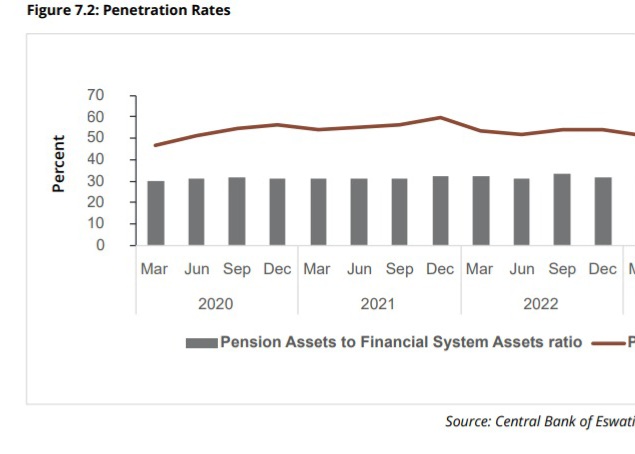

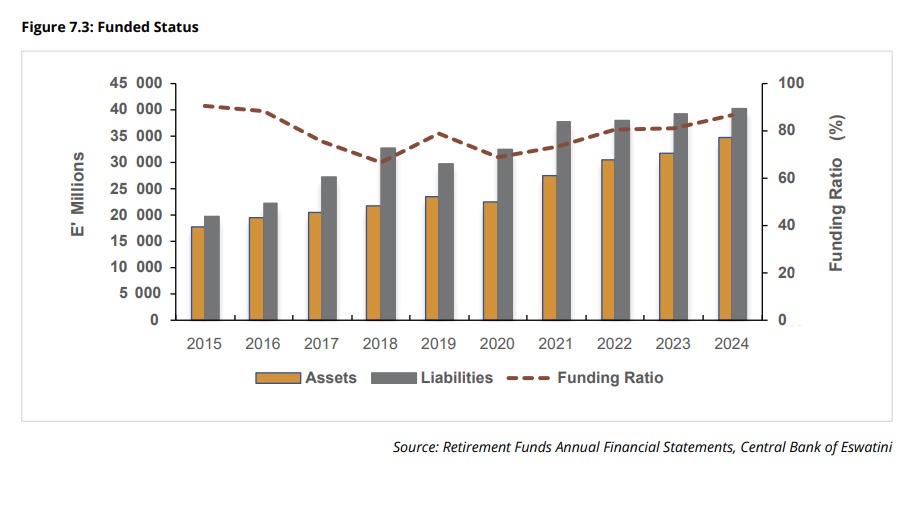

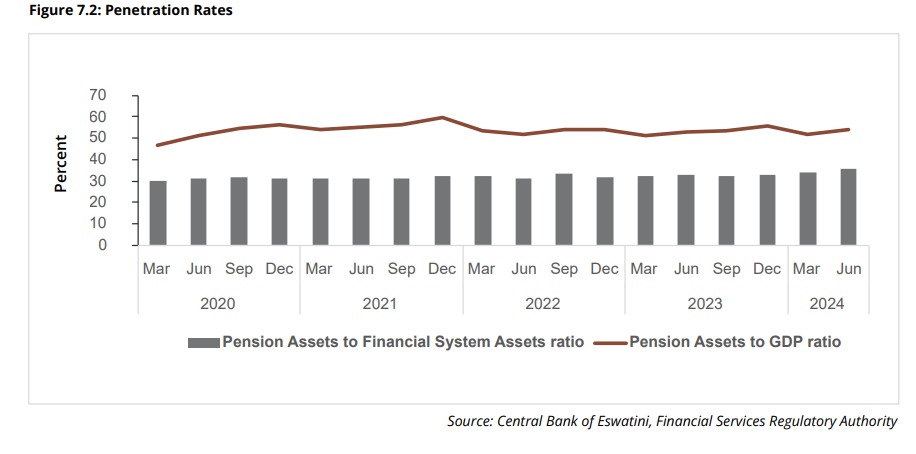

Mnisi stated that the Non-Bank Financial Institutions (NBFIs) sector, including pension funds and insurance companies, remains a critical part of Eswatini’s financial system.

“The pension sector saw substantial growth, with assets increasing by 11.6%, reaching E50.1 billion. This growth in pension assets provides a strong foundation for long-term financial stability and highlights the sector’s vital role in our economy,” he said

However, the Governor highlighted emerging risks, particularly in the concentration of assets and exposure to external markets.

He said while pension funds are well-capitalized, their substantial investments in foreign assets make them vulnerable to external market shocks.

“Moreover, the insurance sector, especially the short-term insurance segment, has faced profitability constraints, although the long-term insurance sector has demonstrated resilience,” he said.

He said the NBFIs sector continues to face challenges with transparency, especially regarding credit risk.

“A growing proportion of household debt, which is exposed to unsecured lending, raises concerns about the stability of the banking and NBFIs sectors. The sectors’ reliance on non-bank lending, accounting for 51.6% of household credit, requires ongoing vigilance to ensure that risks are properly managed,” he said.

On another note, Mnisi stated that the performance of Eswatini’s Financial Market Infrastructures has remained strong.

He said the Swaziland Interbank Payment and Settlement System (SWIPSS), and other clearing and settlement systems, have shown resilience, handling an increased volume of transactions.

“In the year to June 2024, SWIPSS processed 55,389 transactions valued at E320.1 billion, with an 11.1% increase in transaction value. This underscores the growing importance of digital payment channels and the financial sector’s adaptation to new technologies,” he said.

He said the shift towards mobile money and electronic payments is reshaping the financial landscape.

“However, this increase in digital transactions also increases cybersecurity and fraud risks. As we move forward, we must continue to bolster our cybersecurity measures and ensure that financial market infrastructures can withstand potential disruptions,” he said.