By Mbongeni Ndlela

MBABANE – The World Bank and Government have launched a landmark Public Finance Review (PFR), marking the country’s first comprehensive fiscal assessment since 1996.

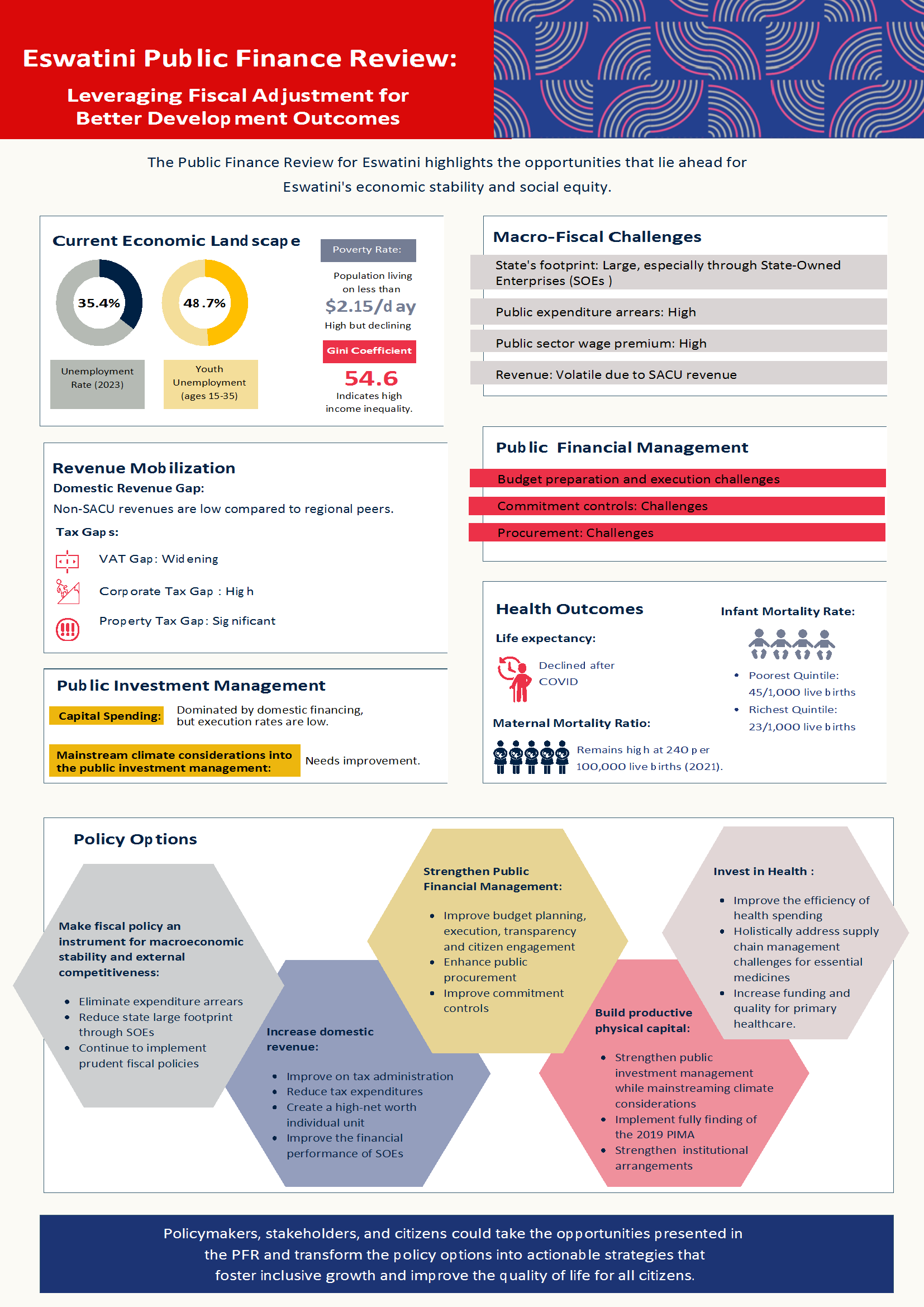

The report, titled Eswatini Public Finance Review: Leveraging Fiscal Adjustment for Better Development Outcomes, provides an in-depth analysis of Eswatini’s fiscal policies and proposes key reforms aimed at ensuring sustainable economic growth, improved public spending efficiency, and social equity.

A strong recovery, but challenges remain

The review acknowledges Eswatini’s impressive economic recovery following the COVID-19 pandemic, with an average growth rate of 5.3% between 2021 and 2023. However, it also highlights pressing fiscal challenges, including the need for stronger financial management, more efficient resource allocation, and a reduction in expenditure arrears that continue to hamper private sector growth.

Minister of Finance Neal Rijkenberg emphasized that while Eswatini has made significant progress in reducing its fiscal deficit since 2019, further reforms are needed.

“The government has taken important steps to stabilize our economy. However, this review provides clear recommendations that can help us create a more competitive and resilient fiscal framework,” he said.

Key reform areas for a stronger economy

The PFR outlines several priority areas where reforms are essential for economic sustainability:

- Revenue Mobilization: Eswatini must improve tax collection efficiency, particularly by introducing measures such as a specialized tax unit for high-net-worth individuals and expanding electronic tax filing. These changes could increase revenue by 1.6% to 3.3% of GDP.

- Public Financial Management (PFM): Strengthening budget preparation and execution, implementing better commitment controls, and streamlining public procurement through electronic solutions could ensure that public funds are utilized effectively.

- Public Investment and Climate Considerations: Mainstreaming climate finance into Eswatini’s fiscal policies is a key recommendation. The government has already developed new Public Investment Management Guidelines to enhance the preparation and execution of capital projects.

- Health Sector Efficiency: The review identifies inefficiencies in public health spending, where high expenditures have not translated into better health outcomes. Addressing supply chain management, enhancing financial oversight, and prioritizing primary healthcare will be crucial in strengthening the sector.

Satu Kahkonen, the World Bank Country Director for Eswatini, emphasized the importance of leveraging fiscal policy for sustainable growth.

“Eswatini’s future hinges on its ability to implement strategic fiscal reforms. The World Bank remains committed to supporting the country in achieving financial sustainability and inclusive growth,” she stated.

Making fiscal policy an instrument for development

The report suggests that Eswatini can make fiscal policy a tool for macroeconomic stability and external competitiveness. Historical economic trends indicate that growth was initially driven by prudent fiscal management and foreign capital inflows, but recent years have seen an overreliance on consumption rather than investment. This has resulted in fiscal deficits and growing expenditure arrears, necessitating the need for stronger financial controls.

To address these issues, government has pursued fiscal consolidation through its Fiscal Adjustment Plan (FAP) since 2021. The establishment of the Revenue Stabilization Fund in 2023 was a significant step toward mitigating the volatility of Southern African Customs Union (SACU) transfers, which heavily influence the country’s revenue flow.

A roadmap for strengthening public finances

The PFR presents a five-pillar approach to strengthen public finances in Eswatini:

- Containing Expansionary Fiscal Policy: Ensuring that government spending remains within sustainable limits while eliminating arrears and reducing the wage gap between the public and private sectors.

- Enhancing Tax Administration: Simplifying tax registration, broadening the tax base, and ensuring compliance to improve revenue collection.

- Reforming State-Owned Enterprises (SOEs): Many SOEs remain financially inefficient and rely on government transfers. Reforms could help SOEs operate more independently, contribute more to public revenue, and ease fiscal burdens.

- Strengthening Public Investment: Ensuring that capital expenditure is well-targeted and efficiently executed, while integrating climate resilience into financial planning.

- Improving Healthcare Management: Enhancing budget oversight, strengthening supply chains for essential medicines, and improving service delivery, particularly in rural areas.

An optimistic outlook for economic reform

Despite the fiscal challenges Eswatini faces, the Public Finance Review offers a roadmap for achieving long-term financial stability. Government’s commitment to implementing these recommendations will be instrumental in fostering a more competitive economic environment and raising living standards for Emaswati.

“The success of these reforms depends on a collective effort from all stakeholders. We are optimistic that Eswatini can build a stronger, more resilient economy that benefits all citizens,” concluded Minister Rijkenberg.

As the country moves forward with its fiscal reforms, collaboration between government, private sector, and international partners such as the World Bank will be critical. With effective implementation, Eswatini has the potential to transform its fiscal landscape, ensuring prosperity and economic stability for years to come.